Resources

FAQS

Q: Do you work with XERO?

A: Yes we do, and we have a strong working relationship with the team there.

Q: How to I perform end to end testing with XERO?

A: For XERO partner, please provide us with your keys and secret so that we can set it up on your database. If you are not a XERO partner, we can support you to obtain XERO partnership, as we have direct links to the XERO team.

For XERO Public, please create a XERO app. NOTE all finance companies must register for XERO partner before they are live.

Q: How to I perform end to end testing with Sage 50?

A: You will need to download a Sage 50 free trial and restore an anomymised backup that we provide.

Q: How to I perform end to end testing with Quickbooks Online?

A: You will need to obtain a Quickbooks Online Sandbox and we will provide a connector to facilitate testing.

Q: How does lastUploadDate Work?

A: lastUploadDate is a timestamp (seconds from 1970) and is only available if there were a last upload.

Q: Can we get a time estimation at the start of the data upload process, so we can communicate to the user when we expect to have their accounting data?

A: The Webhook can only provide loading statuses e.g. Loading, Aborted, Processing, Failed, Or Completed.

Q: If I have to use the periods do you have an easy way to identify the companies year end/start date?

A: The Get Periods endpoint can provide this information (https://developer.validis.com/#get-periods) as long as it is set in the source accounting package.

Q: Can a user have 2 uploads active at the same time?

A: No you cannot.

Q: How do I managed data field identified as displayflipped?

A: Store data as provided at rest and change if required for the UI using displayflipped value. Eg. -1 becomes 1, if displayflipped is true.

Q: What data do you take and how much of it?

A: We extract the financial records in the GL, AP, AR. All data is extracted for all connector, except Navision and Sage 200.

Types

The following types will be shown in the API responses:

| Type | Description | Value type |

|---|---|---|

| Label | This is a name of the value. It will include the key and display value for the element. | Both the key and display value will be Strings. |

| Amount | This is a numeric value. It will include the value and an indicator | Integer |

| Percentage | This is a percentage value. The format of the value will be the actual percentage, not a decimal value e.g. 0.5 is 0.5% and not 50% which is the decimal value. | Decimal |

| Ratio | This is a percentage value. The format of the value will be the decimal percentage, not the actual value e.g. 0.5 is 50% and not 0.5% which is the decimal value. | Decimal |

Validis Chart of Account

As part of the normalisation process, DataShare maps the general ledger accounts to the Validis Chart of Accounts (CoA). The CoA comprises of Primary Categories and Tags.

Primary Category

Each general ledger account is associated to a primary category allowing to identify its position within Income Statement or Balance Sheet reports. There are 8 Primary Categories which are divided into the ones included in the Income Statement and Balance Sheet:

Income Statement (Profit and Loss):

| Primary Category | Primary Category Description |

|---|---|

| SALES | Revenue |

| COST_OF_SALES | Cost of Revenue |

| OPERATING_EXPENSES | Expenses |

Balance Sheet:

| Primary Category | Primary Category Description |

|---|---|

| FIXED_ASSETS | Non Current Assets |

| CURRENT_ASSETS | Current Assets |

| CURRENT_LIABILITIES | Current Liabilities |

| LONG_TERM_LIABILITIES | Non Current Liabilities |

| CAPITAL_AND_RESERVES | Capital & Reserves |

Tags

Each general ledger account is associated with a tag allowing to identify it and present more granular reports. Here is a list of tags and their associated Primary categories that are used:

| Primary Category Tag (UI Name) Tag (Code Name) |

Description |

|---|---|

| SALES Contributions Revenues CONTRIBUTION_REVENUES |

Contributions are funds received by not-for-profit organisations (also known as Charities), from private or corporate donors. They are one of the main forms of Revenue received by not-for-profit organisations. Contributions received will be classified as Income (in the Income Statement), whereas Contributions Receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Contributions, that have been classified by the business under Primary Category - Revenue. |

| SALES Grants Revenues GRANT_REVENUES |

Grants are funds received by not-for-profit organisations (also known as Charities), from governmental authorities. They are one of the main forms of Revenue received by not-for-profit organisations. Grants received will be classified as Income (in the Income Statement), whereas Grants Receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Grants, that have been classified by the business under Primary Category - Revenue. |

| SALES In-Kind Revenues IN_KIND_REVENUES |

In-Kinds Revenues are revenues made by donors to not-for-profit organisations (also known as Charities), that are not in cash but in-kind (e.g. free goods or free services provided). This tag captures all general ledger accounts for In-Kind Revenues, that have been classified by the business under Primary Category - Revenue. |

| SALES Program Revenues PROGRAM_REVENUES |

Program Revenues are funds received by not-for-profit organisations (also known as Charities), from their operating activities. They are one of the main forms of Revenue received by not-for-profit organisations. Program Revenues received will be classified as Income (in the Income Statement), whereas Program Revenues Receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Program Revenues, that have been classified by the business under Primary Category - Revenue. |

| SALES Rental Income RENTAL_INCOME |

Some business’s revenue may consist primarily of Rents received from immovable property that is either owned by the business or rented by the business. This tag captures those general ledger accounts for Rental Income, that have been classified by the business under Primary Category - Revenue. |

| SALES Revenue SALES_TAG |

This tag captures all general ledger accounts not captured by all the other tags in Primary Category - Revenue. |

| COST_OF_SALES Depreciation COST_OF_SALES_DEPRECIATION |

Depreciation is the charge made for the fall in value of Property, Plant & Equipment. This tag captures the depreciation accounts, that have been classified by the business under Primary Category - Cost of Revenue (e.g. depreciation on plant used to produce the goods made by the business) |

| COST_OF_SALES Direct Staff Costs OTHER_DIRECT_LABOUR |

This tag captures general ledger accounts that include the cost of Wages and Salaries paid to employees, that have been classified by the business under Primary Category - Cost of Revenue (e.g. wages of factory employees). |

| COST_OF_SALES Directors Remuneration DIRECTORS_DIRECT_LABOUR |

This tag captures general ledger accounts that include wages and salaries paid by the company to its directors, that have been classified by the company under Primary Category - Cost of Revenue. |

| COST_OF_SALES Employee Benefits EMPLOYEE_BENEFITS |

Apart from wages and salaries, businesses can pay or provide their employees with other benefits (e.g. free medical care). This tag captures all general ledger accounts for Employee Benefits, that have been classified by the business under Primary Category - Cost of Revenue. |

| COST_OF_SALES In-Kind Expenses IN_KIND_EXPENSES |

In-Kinds Expenses are expenses directly relating to In-Kind Revenues (see below). Such expenses can be classified under Primary Category - Cost of Revenue or Primary category - Expenses. In-Kinds Revenues are revenues made by donors to not-for-profit organisations (also known as Charities), that are not in cash but in-kind (e.g. free goods or free services provided). This tag captures all general ledger accounts for In-Kind Expense, that have been classified by the business under Primary Category - Cost of Revenue. |

| COST_OF_SALES Payroll Taxes PAYROLL_TAXES |

Apart from wages and salaries paid to employees and directors, business will need to deduct payroll taxes and make additional employment contributions (e.g. national insurance). These employment costs can be classified as Cost of Revenue or Expenses. This tag captures all general ledger accounts that are related to payroll taxes, that have been classified by the business under Primary Category - Cost of Revenue. |

| COST_OF_SALES Other Costs of Revenue OTHER_COST_OF_SALES |

This tag captures all general ledger accounts not captured by all the other tags in Primary Category - Cost of Revenue. |

| OPERATING_EXPENSES Amortization PL_AMORTISATION |

Amortization is the charge made for the fall in value on intangible assets, such as goodwill. This tag captures the general ledger accounts for amortization charges, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Bad Debts BAD_DEBTS |

Bad debts are the expense created when a client does not settle their dues to the business. The business has to then write-off the balance. This tag captures all general ledger accounts for bad debts, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Corporation Tax CORPORATE_TAX |

A business can classify Income Taxes (also known as corporation tax) in the Income Statement under Primary Category - Expenses, or in the Balance Sheet, under Primary Category - Capital & Reserves. This tag captures all general ledger accounts for income taxes or corporation tax, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Depreciation DEPRECIATION |

Depreciation is the charge made for the fall in value on property, plant & equipment. This tag captures all general ledger accounts for the Depreciation, that have been classified by the business under Primary Category - Expenses (e.g. depreciation on furniture & fittings or office equipment) |

| OPERATING_EXPENSES Directors’ Remuneration DIRECTORS_REMUNERATION |

This tag captures general ledger accounts that include Wages and Salaries paid by the company to its directors, that have been classified by the company under Primary Category - Expenses. |

| OPERATING_EXPENSES Disposal DISPOSAL |

Businesses can occasionally sell tangible assets that they own. When this happens the business can make either a profit or a loss on the sale, depending upon whether the business receives more or less than the depreciated value of the tangible assets. This tag captures general ledger accounts that include Profits or Losses on Disposal, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Dividends DIVIDENDS |

A business can classify Dividends in the Income Statement under Primary Category - Expenses or in the Balance Sheet under Primary Category - Capital & Reserves. This tag captures all general ledger accounts for Dividends, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Employee Benefits EMPLOYEE_BENEFITS |

Apart from wages and salaries, businesses can pay or provide their employees with benefits such as free medical care. This tag captures all general ledger accounts for Employee Benefits, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Exchange Differences EXCHANGE_DIFFERENCES |

A business can receive or pay money in a foreign currency. They can also hold assets or liabilities in a foreign currency. When any money is received/paid, or the value of assets and liabilities are translated into the base currency, a profit or loss can be registered. This tag captures all general ledger accounts for Exchange Differences, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Financial charges and Interest BANK_CHARGES_AND_INTEREST |

A business can pay Interest to lending organisations or other businesses, as well as pay other financial charges such as bank charges. This tag captures all general ledger accounts for Financial Charges and Interest, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES In-Kind Expenses IN_KIND_EXPENSES |

In-Kinds Expenses are expenses directly relating to In-Kind Revenues (see below). Such expenses can be classified under Primary Category - Cost of Revenue or Primary category - Expenses.In-Kinds Revenues are revenues made by donors to not-for-profit organisations (also known as Charities), that are not in cash but in-kind (e.g. free goods or free services provided).This tag captures all general ledger accounts for In-Kind Expense, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Interest Receivable INTEREST_RECEIVABLE |

Business can receive Interest from any cash deposited in financial institutions or lent to other business.This tag captures general ledger accounts that include Interest Received, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Investment Impairment PL_IMPAIRMENT |

Impairment is the charge made for the fall in value of investments owned by the business. This tag captures general ledger accounts that include Investment Impairment, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Investment Income INVESTMENT_INCOME |

Business can receive income from its investment (e.g. dividends received from subsidiaries). This tag captures general ledger accounts that include Income from Investments, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Non-Operating Income/Expenses OTHER_INCOME |

Businesses can be in receipt of other non-operating income such as dividends received, or pay other non-operating expenses such as tax penalties. This tag captures all general ledger accounts for Non-Operating Income and Expenses, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Occupancy Costs OCCUPANCY_COSTS |

This tag captures general ledger accounts that include expenses relating to occupying property primarily rental costs, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Payroll Costs OTHER_GROSS_WAGES |

This tag captures general ledger accounts that include the cost of wages and salaries paid to employees, that have been classified by the business under Primary Category - Expenses (e.g. salaries of office staff). |

| OPERATING_EXPENSES Payroll Taxes PAYROLL_TAXES |

Apart from wages and salaries paid to employees and directors, business will need to deduct payroll taxes and make additional employment contributions (e.g. national insurance). These employment costs can be classified as Cost of Revenue or Expenses. This tag captures all general ledger accounts that are related to Payroll Taxes, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Professional Fees PROFESSIONAL_FEES |

This tag captures all general ledger accounts that are related to the cost of hiring professionals to advise the business (such as lawyers, architects and accountants), that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Repairs and maintenance REPAIRS_AND_MAINTENANCE |

This tag captures all general ledger accounts that are related to the cost of repairing and maintaining the property and equipment the business owns or rents, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Research and Development RESEARCH_AND_DEVELOPMENT |

This tag captures all general ledger accounts that are related to the costs of any research or product/process development the business carries out, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Sales and Marketing SALES_AND_MARKETING |

This tag captures all general ledger accounts that are related to the costs of sales and marketing activities (such as advertising, public relations, entertaining and product promotion), that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Suspense and Mispostings SUSPENSE_AND_MISPOSTINGS |

Suspense and mispostings accounts are used when certain transactions cannot be properly classified due to a lack of understanding of their origin. These accounts are temporary in nature and should not have closing balances. This tag captures all general ledger accounts that are Suspense or Mispostings accounts, that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Telecommunications TELECOMMUNICATIONS |

This tag captures all general ledger accounts that are related to the cost of Telecommunications (such as telephones, broadband and mobile phones), that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Utilities UTILITIES |

This tag captures all general ledger accounts that are related to the cost of Utilities (such as electricity, gas and water), that have been classified by the business under Primary Category - Expenses. |

| OPERATING_EXPENSES Other Operating Costs OTHER_OPERATING_EXPENSES_TAG |

This tag captures all general ledger accounts not captured by all the other tags in Primary Category - Expenses. |

| Primary Category Tag (UI Name) Tag (Code Name) |

Description |

|---|---|

| FIXED_ASSETS Contributions Receivables CONTRIBUTIONS_RECEIVABLE |

Contributions are funds received by not-for-profit organisations (also known as Charities), from private or corporate donors. They are one of the main forms of Revenue received by not-for-profit organisations. Contributions received will be classified as Income (in the Income Statement), whereas contributions receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Contributions Receivable, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Deferred Tax DEFERRED_TAX_ASSETS_LONG_TERM |

Deferred Tax is a provision for taxes that will materialise in future years.This tag captures all general ledger accounts for Deferred Tax, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Goodwill - Cost GOODWILL_ASSETS_COST |

A business can buy another business or company. Goodwill is the value that a business pays over and above the value of the assets acquired from the business bought. This tag captures all general ledger accounts for the cost of Goodwill, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Goodwill Amortization GOODWILL_ASSETS_AMORT |

The value of goodwill will be depreciated over time. Depreciation for goodwill is called amortization. This tag captures all general ledger accounts for the Amortization of Goodwill, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Grants Receivable GRANTS_RECEIVABLE |

Grants are funds received by not-for-profit organisations (also known as Charities), from governmental authorities. They are one of the main forms of Revenue received by not-for-profit organisations. Grants received will be classified as Income (in the Income Statement), whereas grants receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Grants Receivable, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Income Taxes Payable CORPORATION_TAX_DUE |

Companies can sometimes be due taxes that they have overpaid. This tag captures all general ledger accounts that include balances relating to overpaid tax, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Investments - Cost INVESTMENT_ASSETS_COST |

Businesses can make investments (e.g. subsidiaries) that they intend holding for longer than one year. This tag captures all general ledger accounts that include the cost of Investments, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Investments - Impairment INVESTMENT_ASSETS_DEPR |

The value of investments can fall and the business will record this as an impairment expense in the Income Statement, and a provision for a fall in value in the Balance Sheet. This tag captures all general ledger accounts that include the accumulated Impairment of Investments, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Land & Buildings - Cost LAND_AND_BUILDING_COST |

Businesses can acquire Land & Buildings that they intend holding for the long term. This tag captures all general ledger accounts for the cost of Land & Buildings acquired, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Land & Buildings - Depreciation LAND_AND_BUILDING_DEP |

Businesses can acquire land & buildings to own for the long term. Buildings will be depreciated over a long period of time, and the business will provide for this deprecation by charging the Income Statement and crediting the Land & Buildings - Depreciation account. This tag captures all general ledger accounts for the accumulated Depreciation of land & buildings acquired, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Other Intangible Assets - Cost OTHER_INTANGIBLE_ASSETS_AMORT |

Apart from the acquisition of goodwill, a business can acquire Other Intangible Assets, such as patents, trademarks and copyrights. This tag captures all general ledger accounts for the cost of Other Intangible Assets acquired, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Other Intangible Assets - Amortization OTHER_INTANGIBLE_ASSETS_COST |

Apart from the acquisition of goodwill, a business can acquire other intangible assets, such as patents, trademarks and copyrights. These intangible assets will need to be depreciated (termed amortization for intangibles) and the business will provide for this amortization by charging the Income Statement and crediting the account(s) for Other Intangible Assets - Amortization. This tag captures all general ledger accounts for the Amortization of Other Intangible Assets acquired, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Other Property, Plant & Equipment - Cost TANGIBLE_ASSETS_COST |

This tag captures all general ledger accounts (with a debit closing balance) not captured by all the other tags in Primary Category - Non Current Assets. |

| FIXED_ASSETS Other Property, Plant & Equipment - Dep TANGIBLE_ASSETS_DEPR |

This tag captures all general ledger accounts (with a credit closing balance) not captured by all the other tags in Primary Category - Non Current Assets. |

| FIXED_ASSETS Plant & Machinery - Cost PLANT_AND_MACHINERY_COST |

Businesses can acquire plant & machinery, normally if they are manufacturers. This tag captures all general ledger accounts for the Cost of Plant & Machinery acquired, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Plant & Machinery - Depreciation PLANT_AND_MACHINERY_DEP |

Businesses can acquire plant & machinery, which will be depreciated over a number of years, and the business will provide for this deprecation by charging the Income Statement and crediting the Plant & Machinery - Depreciation. This tag captures all general ledger accounts for the Accumulated Depreciation of Plant & Machinery acquired, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Program Revenues Receivable PROGRAM_REVENUES_RECEIVABLE |

Program Revenues are funds received by not-for-profit organisations (also known as Charities), from their operating activities. They are one of the main forms of Revenue received by not-for-profit organisations. Program Revenues received will be classified as Income (in the Income Statement), whereas Program Revenues Receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Program Revenues Receivable, that have been classified by the business under Primary Category - Non Current Assets. |

| FIXED_ASSETS Related Company Balances RELATED_COMPANY_BALANCES |

Businesses can lend money to other businesses or companies that they are related to (e.g. subsidiaries, parents). This tag captures all general ledger accounts that have balances due from Related Companies, that have been classified by the business under Primary Category - Non Current Assets. |

| CURRENT_ASSETS Accounts Receivable DEBTORS_CONTROL |

Accounts Receivable is the general ledger account(s) that hold all the transactions relating to the sales the business makes to its customers, and the money received from those customers. This tag captures all general ledger accounts that are Accounts Receivables accounts, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Bad Debt Provision BAD_DEBT_PROVISION |

Businesses can have doubts about whether certain of their customers can pay up their dues. When this happens the business can make provisions for this uncertainty. This tag captures accounts which are Bad Debt Provisions, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Bank Loans BANK_LOANS_SHORT_TERM |

Businesse can borrow money from banks. On rare occasions businesses may incorrectly classify bank loans under Current Assets, instead of Current Liabilities. This tag captures all general ledger accounts that are related to loans, that have been wrongly classified by the business as Primary Category - Current Assets. |

| CURRENT_ASSETS Bank, Cash and Overdrafts BANK_ACCOUNT |

Businesses can hold cash, either in liquidity form (i.e. petty cash) or as bank balances. This tag captures any general ledger accounts for cash and bank balances, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Contributions Receivable CONTRIBUTIONS_RECEIVABLE |

Contributions are funds received by not-for-profit organisations (also known as Charities), from private or corporate donors. They are one of the main forms of Revenue received by not-for-profit organisations. Contributions received will be classified as Income (in the Income Statement), whereas Contributions receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Contributions Receivable, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Deferred Tax DEFERRED_TAX_ASSETS_SHORT_TERM |

Deferred Tax is a provision for taxes that will materialise in future years. This tag captures all general ledger accounts for Deferred Tax, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Directors Loans DIRECTORS_LOANS_SHORT_TERM |

A company can lend money to its own directors. This tag captures all general ledger accounts that include balances due from its own directors, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Grants Receivable GRANTS_RECEIVABLE |

Grants are funds received by not-for-profit organisations (also known as Charities), from governmental authorities. They are one of the main forms of Revenue received by not-for-profit organisations. Grants Received will be classified as Income (in the Income Statement), whereas Grants Receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Grants Receivable, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Income Taxes Payable CORPORATION_TAX_DUE |

Companies can sometimes be due taxes that they have overpaid. This tag captures all general ledger accounts that include balances relating to overpaid tax, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Inventories: Other CURRENT_ASSETS_STOCK |

Businesses can hold inventories (also know as stocks). Inventories can be essentially raw materials, which are used to manufacture or assemble products, or other inventories such as finished goods or work in progress. This tag captures all general ledger accounts that hold balances for inventories apart from raw materials, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Inventories: Raw Materials RAW_MATERIALS |

Businesses can hold inventories (also know as stocks). Inventories can be essentially raw materials, which are used to manufacture or assemble products, or other inventories such as finished goods or work in progress. This tag captures all general ledger accounts that hold balances for inventories that are raw materials, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Investments-Cost INVESTMENT_ASSETS_SHORT_TERM_COST |

Businesses may make investments (e.g. subsidiaries) that they intend to dispose of within the next 12 months. This tag captures all general ledger accounts that include the Cost of Investments, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Investments-Impairment INVESTMENT_ASSETS_SHORT_TERM_DEPR |

The value of investment can fall and the business will record this as an Impairment Expense in the Income Statement, and a provision for a fall in value in the Balance Sheet.This tag captures all general ledger accounts that include the Accumulated Impairment of Investments, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Net VAT Liability NET_VAT_LIABILITY |

Businesses can owe money to tax authorities for the collection of value added tax (VAT in the UK and Ireland) or sales taxes (in USA and Canada). There are situations where businesses are due value added tax (in the UK and Ireland) rather than owe VAT. This tag captures all general ledger accounts that include balances for Value Added Tax which are due from tax authorities to the business. These accounts would have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Other Loans OTHER_LOANS_SHORT_TERM |

Businesses can loan out money to individuals and/or organisations. This tag captures all general ledger accounts that show these Loans due to the business, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Other Receivables DEBTORS_OTHER |

Businesses could be owed money from a business or individual that is not one of its customers. This tag captures all general ledger accounts that show balances for Other Receivables, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Payroll Taxes PAYE_OUTSTANDING |

Businesses will owe the tax authorities money deducted from their employees wages and salaries, as well as any employment contributions made by the business. There are rare instances when the business wrongly classifies these dues as Current Assets rather than Current Liabilities. This tag captures all general ledger accounts that are related to payroll taxes, that have been wrongly classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Prepaid Expenses PREPAYMENTS |

Prepaid expenses (or prepayments) are expenses that have been incurred or paid but that relate to future periods (e.g. prepaid rent for 3 months). These expenses so they are not treated as an charges in the current period but need to carried forward to future periods. This tag captures all general ledger accounts that are related to Prepaid Expenses, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Program Revenues Receivable PROGRAM_REVENUES_RECEIVABLE |

Program Revenues are funds received by not-for-profit organisations (also known as Charities), from their operating activities. They are one of the main forms of Revenue received by not-for-profit organisations. Program Revenues received will be classified as Income (in the Income Statement), whereas Program Revenues Receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Program Revenues Receivables, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Related Company Balances RELATED_COMPANY_BALANCES |

Businesses can lend money to other businesses that they are related to (e.g. subsidiaries, parent company). This tag captures all general ledger accounts that show balances due from Related Companies, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Suspense and Mispostings SUSPENSE_AND_MISPOSTINGS |

Suspense and mispostings accounts are used when certain transactions cannot be properly classified due to a lack of understanding of their origin. These accounts are temporary in nature and should not have closing balances. This tag captures all general ledger accounts that are Suspense or Mispostings accounts, that have been classified by the business under Primary Category - Current Assets. |

| CURRENT_ASSETS Other Current Assets OTHER_CURRENT_ASSETS_TAG |

This tag captures all general ledger accounts not captured by all the other tags in Primary Category - Current Assets. |

| Primary Category Tag (UI Name) Tag (Code Name) |

Description |

|---|---|

| CURRENT_LIABILITIES Accounts Payable CREDITORS_CONTROL |

Accounts Payable is the general ledger account(s) that hold all the transactions relating to the purchases the business makes from its suppliers, and the money paid to its suppliers. This tag captures all general ledger accounts that are Accounts Payables accounts, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Accruals ACCRUALS |

Accruals are provisions for expenses that have been incurred but for which bills have not yet been received (e.g. auditors fees received after year end). This tag captures all general ledger accounts that are related to Accruals, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Bad Debt Provision BAD_DEBT_PROVISION |

Businesses can have doubts about whether certain of their customers can pay up their dues. When this happens the business can make provisions for this uncertainty. This tag captures accounts which are bad debts provisions, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Bank Loans BANK_LOANS_SHORT_TERM |

Business can borrow money from banks or financial institutions. This tag captures all general ledger accounts that are related to Bank Loans outstanding, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Bank, Cash and Overdrafts BANK_ACCOUNT |

Business can have Bank Overdrafts or similar short term borrowing (e.g. credit cards). This tag captures any general ledger accounts that are related to Bank Overdrafts, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Contributions Receivable CONTRIBUTIONS_RECEIVABLE |

Contributions are funds received by not-for-profit organisations (also known as Charities), from private or corporate donors. They are one of the main forms of Revenue received by not-for-profit organisations. Contributions received will be classified as Income (in the Income Statement), whereas Contributions Receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Contributions Receivable, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Deferred Tax DEFERRED_TAX_LIABILITIES_SHORT_TERM |

Deferred Tax is a provision for taxes that will materialise in future years. This tag captures any general ledger accounts for Deferred Tax, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Directors Loans DIRECTORS_LOANS_SHORT_TERM |

A company can borrow money from its own directors. This tag captures all general ledger accounts that include balances owed to its own directors, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Dividends Due DIVIDENDS_DUE |

Companies can declare to its shareholders, but only pay these in a following period. These liabilities are called Dividends Due. This tag captures all general ledger accounts that include Dividends Due, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Grants Receivable GRANTS_RECEIVABLE |

Grants are funds received by not-for-profit organisations (also known as Charities), from governmental authorities. They are one of the main forms of Revenue received by not-for-profit organisations. Grants Received will be classified as Income (in the Income Statement), whereas Grants Receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Grants Receivable, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Hire Purchase Creditors HIRE_PURCHASE_SHORT_TERM |

Business can acquire tangible assets on credit through Hire Purchases agreements. This liability will be repayable over a period of years. This tag captures all general ledger accounts that are Hire Purchase Creditors, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Income Taxes Payable CORPORATION_TAX_DUE |

Companies will generally owe company or corporation tax to tax authorities. This tag captures all general ledger accounts that include balances due to tax authorities, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Lease Creditors LEASES_SHORT_TERM |

Businesses can acquire tangible assets on credit through lease agreements. Leases will be repayable over a period of years. This tag captures all general ledger accounts that are related to Lease Creditors, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Net VAT Liability NET_VAT_LIABILITY |

Businesses can owe money to tax authorities for the collection of value added tax (VAT in the UK and Ireland) or sales taxes (in USA and Canada). This tag captures all general ledger accounts that include balances due for Value added tax or Sales Taxes, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Other Capital Obligations OTHER_CAPITAL_OBLIGATIONS_SHORT_TERM |

Businesses can acquire tangible assets on credit through agreements that are not hire purchase or leases, for example asset finance agreements. These liabilities will be repayable over a period of years. This tag captures all general ledger accounts that related to Capital Obligations, These accounts would have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Other Loans OTHER_LOANS_SHORT_TERM |

Businesses can borrow money from individuals or organisations that are not banks. This tag captures all general ledger accounts that show these Other Loans due, that have been classified by the business under Primary Category - Current Liabilities |

| CURRENT_LIABILITIES Other Payables CREDITORS_OTHER |

Businesses could owe money to a businesses or individual that is not one of its suppliers. This tag captures all general ledger accounts that show balances due to Other Payables, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Payroll Taxes PAYE_OUTSTANDING |

Businesses will owe the tax authorities money deducted from their employees wages and salaries, as well as any employment contributions made by the business. This tag captures all general ledger accounts that are related to payroll taxes, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Program Revenues Receivable PROGRAM_REVENUES_RECEIVABLE |

Program Revenues are funds received by not-for-profit organisations (also known as Charities), from their operating activities. They are one of the main forms of Revenue received by not-for-profit organisations. Program Revenues received will be classified as Income (in the Income Statement), whereas Program Revenues Receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Program Revenues Receivable, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Related Company Balances RELATED_COMPANY_BALANCES |

Businesses can borrow money from other companies that they are related to (e.g. subsidiaries, parent company). This tag captures all general ledger accounts that have balances due to Related Companies, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Suspense and Mispostings SUSPENSE_AND_MISPOSTINGS |

Suspense and mispostings accounts are used when certain transactions cannot be properly classified due to a lack of understanding of their origin. These accounts are temporary in nature and should not have closing balances. This tag captures all general ledger accounts that are Suspense or Mispostings accounts, that have been classified by the business under Primary Category - Current Liabilities. |

| CURRENT_LIABILITIES Other Current Liabilities OTHER_CURRENT_LIABILITIES_TAG |

This tag captures all general ledger accounts not captured by all the other tags in Primary Category - Current Liabilities. |

| LONG_TERM_LIABILITIES Bank Loans BANK_LOANS_LONG_TERM |

Businesses can borrow money from banks or financial institutions. This tag captures all general ledger accounts that are related to Bank Loans outstanding, that have been classified by the business under Primary Category - Non Current Liabilities. |

| LONG_TERM_LIABILITIES Contributions Receivable CONTRIBUTIONS_RECEIVABLE |

Contributions are funds received by not-for-profit organisations (also known as Charities), from private or corporate donors. They are one of the main forms of Revenue received by not-for-profit organisations. Contributions Received will be classified as Income (in the Income Statement), whereas Contributions Receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Contributions Receivable, that have been classified by the business under Primary Category - Non Current Liabilities. |

| LONG_TERM_LIABILITIES Deferred Tax DEFERRED_TAX_LIABILITIES_LONG_TERM |

Deferred Tax is a provision for taxes that will materialise in future years. This tag captures any general ledger accounts for Deferred Tax, that have been classified by the business under Primary Category - Non Current Liabilities. |

| LONG_TERM_LIABILITIES Directors Loans DIRECTORS_LOANS_LONG_TERM |

A company can borrow money from its own directors. This tag captures all general ledger accounts that include balances due to its own directors, that have been classified by the business under Primary Category - Non Current Liabilities. |

| LONG_TERM_LIABILITIES Grants Receivable GRANTS_RECEIVABLE |

Grants are funds received by not-for-profit organisations (also known as Charities), from governmental authorities. They are one of the main forms of Revenue received by not-for-profit organisations. Grants Received will be classified as Income (in the Income Statement), whereas Grants Receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Grants Receivable, that have been classified by the business under Primary Category - Non Current Liabilities. |

| LONG_TERM_LIABILITIES Hire Purchase Creditors HIRE_PURCHASE |

Businesses can acquire tangible assets on credit through Hire Purchases agreements. This liability will be repayable over a period of years. This tag captures all general ledger accounts that are Hire Purchase Creditors, that have been classified by the business under Primary Category - Non Current Liabilities. |

| LONG_TERM_LIABILITIES Income Taxes Payable CORPORATION_TAX_DUE |

Companies will generally owe company or corporation tax to tax authorities. This tag captures all general ledger accounts that include balances due to tax authorities, that have been classified by the business under Primary Category - Non Current Liabilities. |

| LONG_TERM_LIABILITIES Lease Creditors LEASES |

Businesses can acquire tangible assets on credit through Lease agreements. Leases will be repayable over a period of years. This tag captures all general ledger accounts that are related to Lease Creditors, that have been classified by the business under Primary Category - Non Current Liabilities. |

| LONG_TERM_LIABILITIES Other Capital Obligations OTHER_CAPITAL_OBLIGATIONS_LONG_TERM |

Businesses can acquire tangible assets on credit through agreements that are not hire purchase or leases, for example asset finance agreements. These liabilities will be repayable over a period of years. This tag captures all general ledger accounts that are related to Capital Obligations, that have been classified by the business under Primary Category - Non Current Liabilities. |

| LONG_TERM_LIABILITIES Other Loans OTHER_LOANS_LONG_TERM |

Businesses can borrow money from individuals or organisations that are not banks. This tag captures all general ledger accounts that show these Other Loans due, that have been classified by the business under Primary Category - Non Current Liabilities. |

| LONG_TERM_LIABILITIES Program Revenues Receivables PROGRAM_REVENUES_RECEIVABLE |

Program Revenues are funds received by not-for-profit organisations (also known as Charities), from their operating activities. They are one of the main forms of Revenue received by not-for-profit organisations. Program Revenues received will be classified as Income (in the Income Statement), whereas Program Revenues Receivable can be classified as Assets or Liabilities (in the Balance Sheet). This tag captures all general ledger accounts for Program Revenues Receivable, that have been classified by the business under Primary Category - Non Current Liabilities. |

| LONG_TERM_LIABILITIES Related Company Balances RELATED_COMPANY_BALANCES |

Businesses can borrow money from other companies that they are related to (e.g. subsidiaries, parent company). This tag captures all general ledger accounts that have balances due to Related Companies, that have been classified by the business under Primary Category - Non Current Liabilities. |

| LONG_TERM_LIABILITIES Other Long Term Liabilities OTHER_LONG_TERM_LIABILITIES_TAG |

This tag captures all general ledger accounts not captured by all the other tags in Primary Category - Non Current Liabilities. |

| Primary Category Tag (UI Name) Tag (Code Name) |

Description |

|---|---|

| CAPITAL_AND_RESERVES Common stock SHARE_CAPITAL |

Common stock (also known as ordinary share capital), consists of the original capital put into the business by shareholders as well as additional capital put in over the subsequent years. This tag captures all general ledger accounts that are for Common Stock or Ordinary Share Capital, that have been classified by the business under Primary Category - Capital & Reserves. |

| CAPITAL_AND_RESERVES Dividends DIVIDENDS_BS |

A business can classify Dividends in the Income Statement under Primary Category - Expenses or in the Balance Sheet under Primary Category - Capital & Reserves. This tag captures all general ledger accounts for Dividends, that have been classified by the business under Primary Category - Capital & Reserves. |

| CAPITAL_AND_RESERVES Drawings DRAWINGS |

Drawings consist of cash taken out of a partnership (this is not applicable to companies) and paid to partners as part-payment of their share of the profits. This tag captures all general ledger accounts for Drawings, that have been classified by the business under Primary Category - Capital & Reserves. |

| CAPITAL_AND_RESERVES Income Taxes CORPORATE_TAX_BS |

A business can classify Income Taxes (also known as corporation tax) in the Income Statement under Primary Category - Expenses, or in the Balance Sheet under Primary Category - Capital & Reserves. This tag captures all general ledger accounts for Income Taxes or Corporation Tax, that have been classified by the business under Primary Category - Capital & Reserves. |

| CAPITAL_AND_RESERVES Other Equity OTHER_RESERVES |

Businesses can have other accounts that are part of Capital & Reserves, with generic names such as “Other Equity” or “Other Reserves”. This tag captures all general ledger accounts that are related to Other Equity, that have been classified by the business under Primary Category - Capital & Reserves. |

| CAPITAL_AND_RESERVES Preferred stock PREFERENCE_SHARE_CAPITAL |

Preferred stock (also known as preference share capital), consists of capital put into the business by shareholders that earns shareholders a dividend based on a fixed rate of return rather than dividends based on profits made. This tag captures all general ledger accounts that are for Preferred Stock of Preference Share Capital, that have been classified by the business under Primary Category - Capital & Reserves. |

| CAPITAL_AND_RESERVES Profit and Loss Accounts RETAINED_EARNINGS |

The profits made by a business over the years that are retained (i.e. not paid out as dividends) are recorded in the Profit & Loss account (or Retained Profits account) under Primary Category - Capital & Reserves. This tag captures all general ledger accounts for Retained Profits, that have been classified by the business under Primary Category - Capital & Reserves. |

| CAPITAL_AND_RESERVES Revaluation Reserve REVALUATION_RESERVE |

Businesses can revalue immovable property they own if the value goes up. When this happens the value of immovable property (i.e. Land & Buildings) is increased, and a credit entry is made into a Revaluation Account. Revaluation accounts are classified in Capital & Reserves since they effectively increase the Net Asset Value of the business. This tag captures all general ledger accounts that related to Revaluation Accounts, that have been classified by the business under Primary Category - Capital & Reserves. |

| CAPITAL_AND_RESERVES Suspense and Mispostings SUSPENSE_AND_MISPOSTINGS |

Suspense and mispostings accounts are used when certain transactions cannot be properly classified due to a lack of understanding of their origin. These accounts are temporary in nature and should not have closing balances. This tag captures all general ledger accounts that are Suspense or Mispostings accounts, that have been classified by the business under Primary Category - Capital & Reserves. |

Activity Diagrams

Get API Key

Purpose: obtain API Key that is required for all queries in Ocp-Apim-Subscription-Key header, and to authenticate

Requirements: having a client provisioned and being a system admin for it

Authenticate

Purpose: obtain an access token (JWT) that will be required on all other call in Authorization header

Requirements: valid API Key

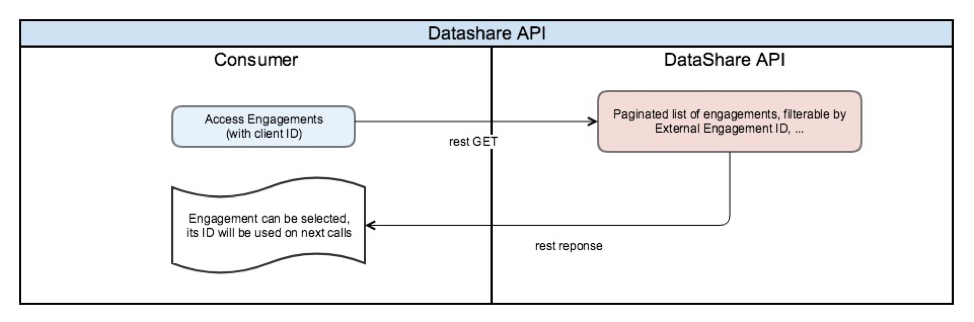

Get Engagement Id

Purpose: obtain and select engagement IDs that will be required to get financial data and reports

Requirements: authenticated and have the client id

Upload API

Purpose: create an engagement which represent the relation between the client, and the SME (represented by contacts)

Requirements: authenticated and have the client id

Initiate an upload

Purpose: initiate an upload for an online or offline package

Requirements: authenticated and have the engagement id

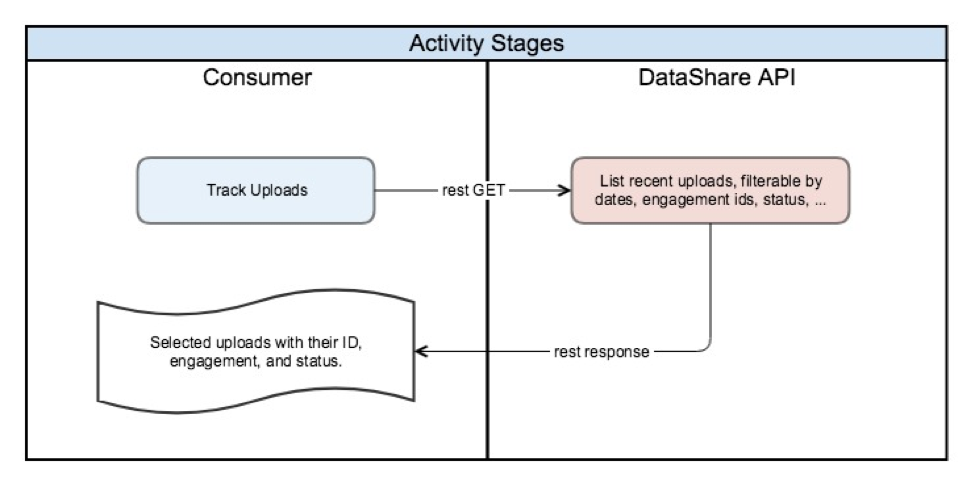

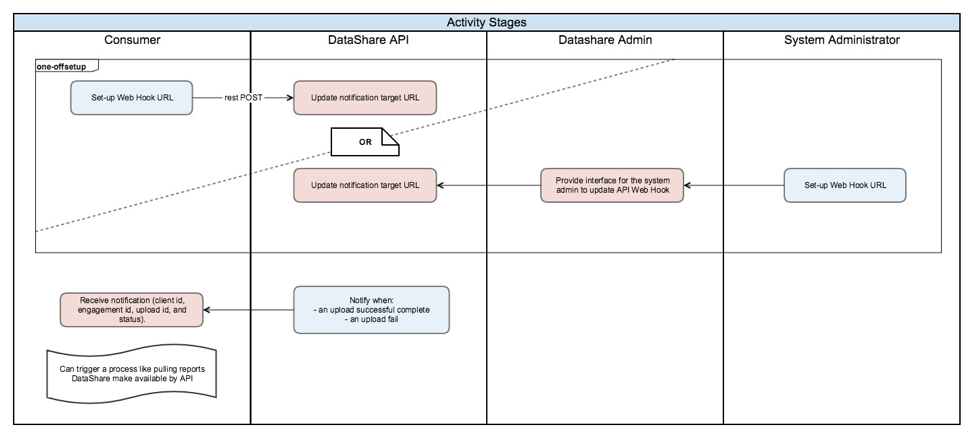

Upload Tracking

Purpose: track uploads, or being notified when an upload has completed (successfully, or with an error)

Requirements: authenticated and have the client id

Pull Option

Notification Option

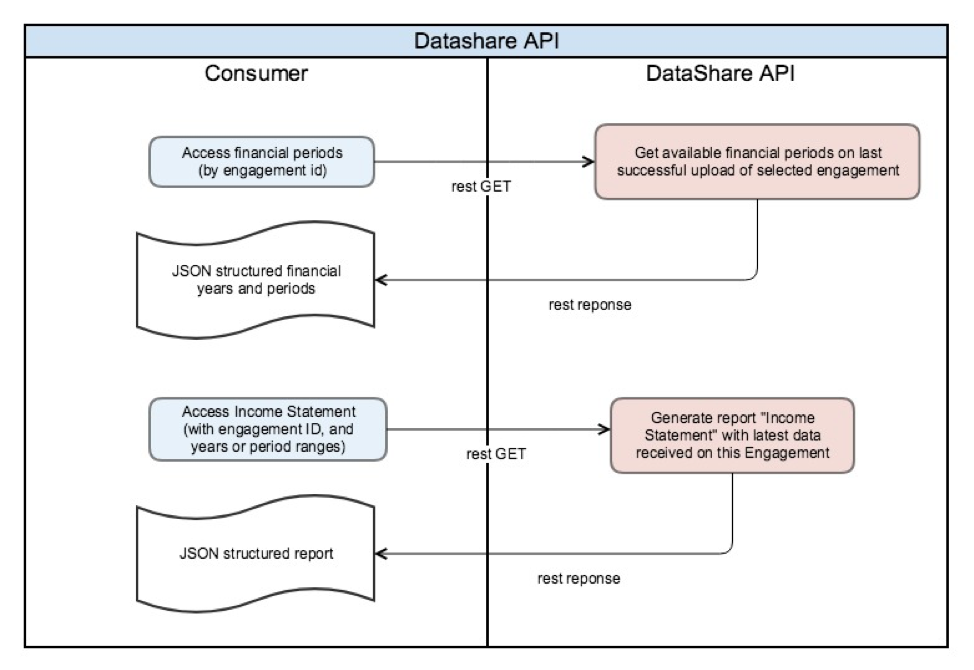

Access Financial Reports

Purpose: Get reports (income statement, balance sheet, or financial snapshot) of an SME

Requirements: authenticated and have the engagement id

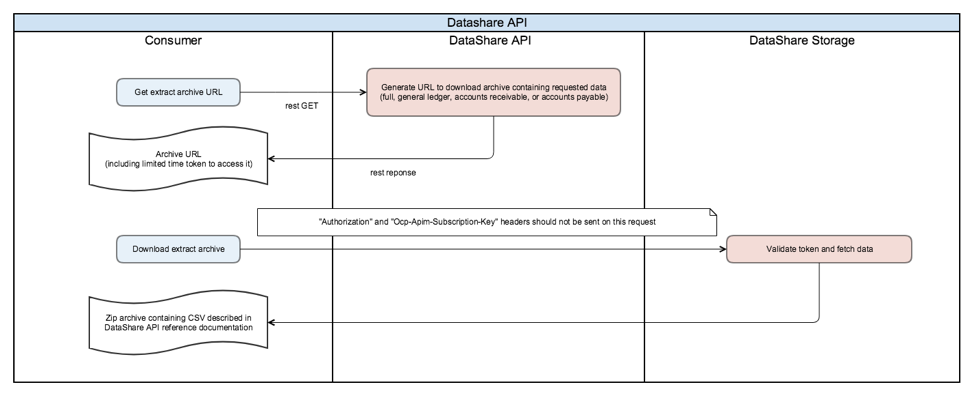

Access CSV Extracts

Purpose: Get a full or subset of uploaded financial data (available: general ledger, accounts receivable, or accounts payable)

Requirements: authenticated and have the engagement id

DataShare Postman Scripts

We offer Postman Scripts to help you start integrating with the DataShare APIs. Postman is a REST client that provides an intuitive user interface to send requests, save responses, add tests, and create workflows.

Download the Scripts and the Environment Variables to get started, all you need to do is add your API key to the variables and you are started!

Postman files to download

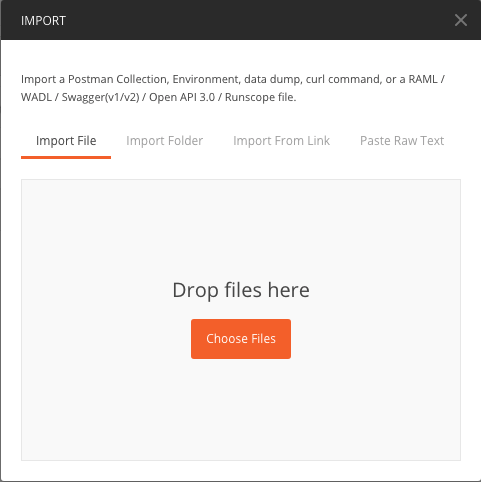

Quick guide to getting started with Postman.

1. If you do not have Postman, download it from here and install it.

2. Open Postman and add the postman collection and environment.

To add the collection, link on the Import button in the top left corner.

Click on the Choose Files button and select the postman collection and environment file you downloaded earlier.

3. Add in the API key to the environment variables.

Click on the Manage Environments button and select the Environment you have just added. Add your API key to the datashareApiKey Current Value

4. Authenticate with the Authenticatation endpoint. This will input the clientId and the JWT Token and will allow you use any of the other endpoints.